Understanding Recruitment Fees: Complete Guide to Agency Costs and Pricing Structures

Recruitment is a crucial investment for any company looking to grow its teams. Faced with today’s labour-market challenges, many organisations turn to a recruitment firm to find the best candidates. But how much does this service really cost?

What Are Recruitment Fees?

Recruitment fees represent the costs organizations pay to external agencies or headhunting firms for sourcing and hiring qualified candidates. These charges compensate recruiters for their expertise, time, and resources invested in identifying suitable talent for your business.

When companies engage recruitment agencies, they essentially outsource a portion of their talent acquisition process. The agency handles candidate sourcing, screening, interviewing, and presenting shortlisted applicants. This service allows internal HR teams to focus on strategic priorities while leveraging the recruiter's specialized networks and market knowledge.

Does your company have a dedicated recruiter searching for candidates all day? If not, understanding recruitment fees becomes essential for making informed hiring decisions. The structure and amount vary significantly based on position level, industry, and market conditions.

How Recruitment Fees Are Structured

Contingency Fee Model (Percentage-Based)

The contingency model remains the most common fee structure in the recruitment industry. Agencies receive payment only when they successfully place a candidate in your organization. According to the Society for Human Resource Management (SHRM), recruitment agency fees typically range from 15% to 25% of the candidate's annual salary.

For a position paying $70,000 per year, you would pay between $10,500 and $17,500 in recruitment fees. This model aligns agency motivation with results—they only earn revenue when delivering successful placements.

The contingency structure offers clear advantages for employers. You face minimal financial risk since payment depends on actual placement. If the agency fails to find a suitable candidate, you owe nothing. This arrangement works particularly well for standard positions where multiple agencies might compete to fill the role.

Retained Search Fee Structure

Retained searches involve an upfront payment to secure the agency's exclusive commitment. Companies typically pay 30% to 50% of the total estimated fee before the search begins, with the balance due upon successful placement. Total fees generally range from 20% to 35% of the candidate's first-year salary.

This model suits executive-level positions or highly specialized roles requiring extensive search efforts. The upfront payment ensures the agency dedicates significant resources to your search, providing personalized attention and strategic partnership throughout the process.

Flat Fee Arrangements

Some agencies offer flat-rate pricing, establishing a fixed amount before the recruitment process starts. These fees typically begin at $10,000 for qualified positions and can extend to $30,000 or more for senior roles.

Flat fees provide budget predictability from the outset. You know exactly what the recruitment will cost regardless of the final salary negotiated with the candidate. This structure works well for companies hiring regularly or for standardized positions where time and resource requirements are predictable.

Hourly Rate Fee Structure

Less common but growing in popularity, hourly rate structures charge clients based on the actual time recruiters spend on the search. Rates vary depending on the recruiter's experience and specialization, typically ranging from $100 to $300 per hour.

This model offers transparency and can be cost-effective for project-based recruitment needs. However, it requires careful tracking and may lack the cost certainty that percentage-based or flat fee models provide.

Comparison Table: Recruitment Fee Structures

| Fee Structure | Typical Range | Payment Timing | Best Suited For | Risk Level |

|---|---|---|---|---|

| Contingency | 15-25% of annual salary | After placement | Standard positions, multiple agencies | Low for employer |

| Retained | 20-35% of annual salary | 30-50% upfront + balance | Executive/specialized roles | Medium |

| Flat Fee | $10,000 - $30,000+ | Agreed schedule | Regular hiring, standardized roles | Medium |

| Hourly Rate | $100 - $300/hour | Monthly or milestone-based | Project-based recruitment | Variable |

Average Recruitment Fees by Industry and Position

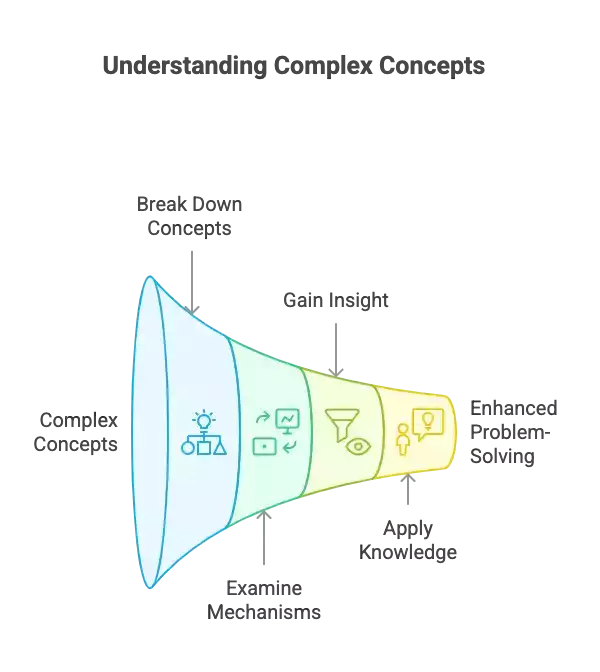

Understanding Cost Variations

How much are recruiting agencies billing clients across different sectors? The answer depends heavily on position level and industry dynamics. SHRM data shows the average cost per hire reached $4,700 in 2023, representing a 14% increase from $4,129 in 2019.

For high-demand fields like cybersecurity, data science, and nursing, costs can surpass $10,000 per hire. These premiums reflect the scarcity of qualified talent and the specialized expertise required to identify and attract top candidates.

Entry-Level to Mid-Level Positions

Entry-level recruitment typically commands fees on the lower end of the percentage scale, around 15% to 18% of annual salary. The higher volume of available candidates and shorter search timelines contribute to these more competitive rates.

Mid-level professional roles generally see fees between 18% and 22%. These positions require more extensive screening and assessment to ensure candidates possess the necessary experience and cultural fit for your organization.

Executive and C-Suite Recruitment

Executive search firms charge premium rates, often 25% to 35% of first-year compensation. Some specialized executive recruiters may charge even higher percentages for particularly difficult searches or niche industries.

These elevated fees reflect the extensive networks, market intelligence, and dedicated resources required for senior-level placements. Executive searches often involve confidential outreach to passive candidates, multiple stakeholder interviews, and comprehensive assessment processes.

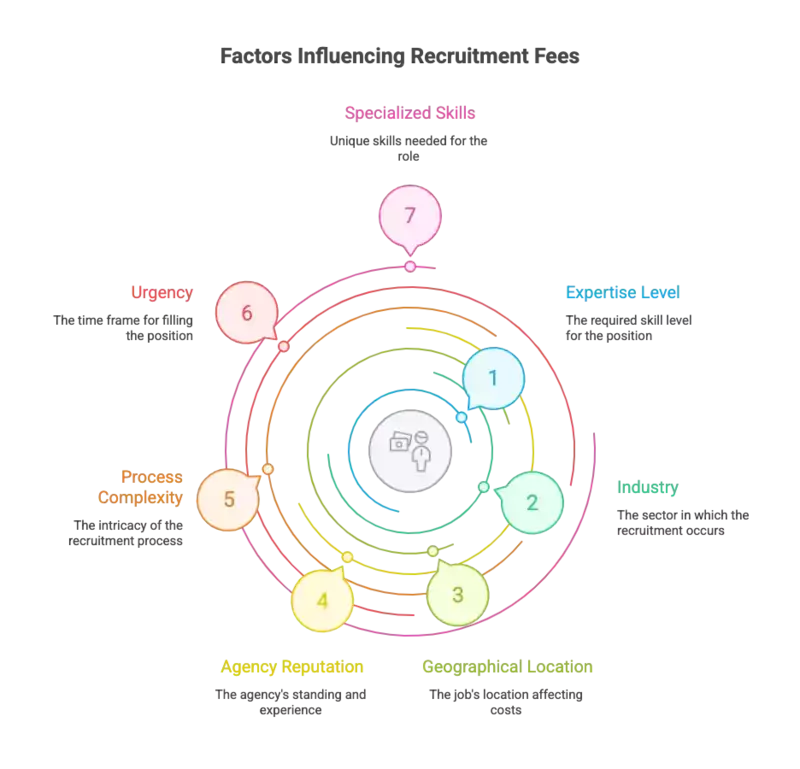

Factors That Influence Recruitment Fees

Position-Specific Variables

The seniority level directly impacts recruitment costs. Executive positions require sophisticated headhunting techniques, longer search times, and personalized approaches to convince passive candidates. This intensive process justifies higher fees.

Skill scarcity plays an equally important role. When specific technical competencies or certifications are rare in the market, agencies invest more time and resources to identify qualified talent. This extended effort translates to higher costs for employers.

Market Conditions and Location

Geographic location significantly affects recruitment fees. Major metropolitan areas typically show higher rates due to elevated costs of living, concentrated competition for talent, and higher average salaries. Regional agencies often offer more competitive rates while providing excellent knowledge of local markets.

Supply and demand dynamics shape pricing structures. In tight labor markets where candidates hold negotiating power, agencies may charge premium rates reflecting the difficulty of securing placements. Conversely, economic downturns with abundant talent can create downward pressure on fees.

Urgency and Timeline Requirements

Need to fill a position immediately? Rush placements typically carry urgency premiums ranging from 20% to 50% above standard rates. Agencies mobilize exceptional resources to accelerate sourcing, prioritize your search, and deploy multiple consultants simultaneously.

This expedited service comes at a cost but can be worthwhile when extended vacancies threaten productivity or revenue. The average time to hire stands at 44 days according to industry data—urgent searches aim to cut this timeline significantly.

Agency Specialization and Reputation

Niche recruiters specializing in specific industries or roles typically charge higher fees than generalist agencies. Their specialized networks, deep market knowledge, and ability to assess technical profiles precisely justify the investment.

An agency's track record and reputation also influence pricing. Firms with proven success rates, extensive candidate databases, and strong employer brands can command premium rates based on their demonstrated value.

Hidden Costs and Additional Fees in Recruitment

Candidate Assessment and Testing Expenses

Beyond the base recruitment fee, several additional costs can impact your total hiring budget. Psychometric testing typically costs €500 to €2,000 per candidate, while skills assessments and technical evaluations add similar amounts.

Background and reference checks represent another expense category, ranging from €200 to €500 per candidate. These verification processes protect your organization but increase the overall cost of recruitment.

Advertising and Job Posting Costs

Job board fees consume a significant portion of recruitment budgets. Posting on platforms like Indeed or LinkedIn costs €300 to €800 per listing. LinkedIn Recruiter licenses, which provide enhanced candidate search capabilities, run €5,000 to €20,000 annually.

Sponsored content and targeted advertising campaigns drive additional expenses. Companies seeking passive candidates often invest in employer branding initiatives that extend beyond basic job postings.

Technology and Operational Charges

Applicant Tracking Systems (ATS) cost between €200 and €1,000 per month depending on features and user volume. According to recent statistics, 98.4% of Fortune 500 companies use ATS platforms to streamline their hiring processes.

Contract preparation, administrative support, and translation services for international recruitment create additional operational costs. These seemingly minor expenses can accumulate to represent 10% to 20% of your total recruitment budget.

Common Hidden Recruitment Costs

- Psychometric and skills testing: €500 - €2,000 per candidate

- Background checks and references: €200 - €500 per candidate

- Job board postings: €300 - €800 per ad

- LinkedIn Recruiter licenses: €5,000 - €20,000 annually

- ATS software subscriptions: €200 - €1,000 monthly

- Travel expenses for candidate interviews

- Translation services for international hires

- Video interview platform fees

How to Calculate Your Total Recruitment Costs

Internal Cost Components

True recruitment costs extend beyond external agency fees. Internal expenses include in-house recruiter salaries, HR team time allocation, and operational overhead. An internal HR recruiter earning €51,000 annually increases hiring costs by at least €4,250 monthly when factoring in benefits and overhead.

The time investment from hiring managers and team members participating in interviews represents opportunity cost. These hours could otherwise contribute to revenue-generating activities or strategic initiatives.

External Agency Fee Calculation

Calculating agency fees starts with understanding the base formula. For contingency arrangements, multiply the candidate's annual salary by the agreed percentage. For a €60,000 position with a 20% fee, you pay €12,000 upon successful placement.

Retained searches require calculating the upfront retainer (typically 30-50% of total fee) and the remaining balance due at placement. Ensure contracts clearly specify what triggers final payment and any conditions for partial refunds.

Cost-Per-Hire Metrics

The cost-per-hire formula divides total recruitment expenses by the number of hires made during a specific period. If you spent €200,000 on recruitment and hired 50 people, your cost-per-hire equals €4,000.

This metric provides valuable benchmarking data. Compare your figures against industry averages to identify optimization opportunities. SHRM reports the median cost per hire at $1,633, while the average sits at $4,700—the difference reflects that some positions cost significantly more to fill than others.

Negotiating Recruitment Agency Fees

Leverage Points for Employers

Can you negotiate fees with a recruitment agency? Absolutely. Volume hiring provides substantial negotiating power. Propose a partnership agreement covering multiple positions to secure preferential rates and priority service.

Exclusive agreements offer another negotiation angle. Granting one agency exclusive rights to your search can justify reduced fees since they face no competition. However, weigh this against the potential benefits of engaging multiple firms simultaneously.

Contract Terms to Review

Guarantee periods typically range from 3 to 12 months. Understand what triggers replacement obligations—voluntary resignation, performance termination, or both? Clarify whether replacements involve full new searches or simply presenting additional candidates from the existing pool.

Payment schedules merit careful attention. Negotiate installment options that align with your cash flow while protecting the agency's interests. Some arrangements allow paying 50% upon placement and 50% after the candidate completes a probationary period.

Building Long-Term Partnerships

Framework agreements establish ongoing relationships with preferred agencies. These contracts often include volume discounts, guaranteed service levels, and standardized processes that improve efficiency over time.

Performance-based pricing ties fees to measurable outcomes beyond simple placement. Metrics might include retention rates, time-to-productivity, or hiring manager satisfaction scores. This approach aligns agency incentives with your long-term talent quality goals.

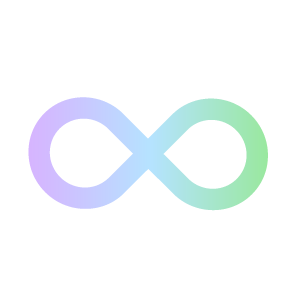

Technology-Driven Disruption of Recruitment Fee Models

AI and Automation Impact on Pricing

How is artificial intelligence reshaping recruitment costs? According to LinkedIn's Global Hiring Trends Report (2024), organizations using skills-based platforms save an average of 30% on recruitment costs compared to traditional methods.

Automated sourcing tools reduce the manual effort required to identify candidates. AI-driven algorithms match candidates to positions based on skills, experience, and cultural fit indicators, eliminating hours of resume screening. These efficiency gains allow agencies to offer more competitive pricing while maintaining profitability.

Data from 2024 shows that 44% of companies incorporated AI into their recruitment processes. This widespread adoption signals a fundamental shift in how talent acquisition operates and what clients should expect to pay for recruiting services.

Platform-Based Recruitment Marketplaces

Recruitment marketplaces represent a disruptive force in traditional agency models. These digital platforms connect employers directly with external recruiters, creating transparency and competition that often results in lower fees.

Unlike conventional arrangements requiring manual negotiation with individual agencies, marketplaces provide centralized hubs to post jobs, compare recruiter profiles, and manage multiple relationships simultaneously. Many operate on pay-for-performance models, ensuring clients only pay for successful hires.

Hiring Notes exemplifies this marketplace approach by connecting companies with qualified recruitment firms through transparent comparisons of offers and rates. This model reduces the time spent searching for suitable partners while natural competition fosters better pricing.

Data-Driven Fee Optimization

Fortune 500 companies using skills-based hiring platforms save an average of $1 million annually on recruitment expenses, according to LinkedIn's Future of Work Report (2025). These savings result from reduced time-to-hire and minimized turnover rates.

Performance analytics enable data-driven decisions about which recruitment channels, agencies, or strategies deliver the best return on investment. Companies can identify which recruiters consistently provide quality candidates and negotiate preferential terms based on demonstrated results.

Dynamic pricing models adjust fees based on market conditions, role difficulty, and historical success rates. This flexible approach replaces rigid percentage-based structures with more nuanced pricing that reflects actual recruitment complexity.

Industry-Specific Fee Variations

Technology and IT Recruitment

Technology sector recruitment commands premium fees due to intense competition for specialized skills. Software engineers, cybersecurity experts, and data scientists represent high-demand profiles where agencies invest substantial resources to identify and engage passive candidates.

Contract versus permanent placement rates differ significantly in tech. Contract roles typically carry fees of 15-20% of the annual contract value, while permanent positions command 20-30% of first-year salary.

Healthcare and Medical Staffing

Healthcare recruitment involves additional complexity from licensing verification, credential checks, and compliance requirements. These factors contribute to higher fees, particularly for physicians, specialists, and nursing leadership positions.

Geographic demand variations impact pricing substantially. Rural areas struggling to attract medical professionals may see premium fees compared to urban centers with larger talent pools.

Finance and Legal Sectors

Financial services and legal recruitment often involve confidentiality premiums. Senior positions require discrete outreach to passive candidates without alerting current employers, necessitating sophisticated approach strategies.

Partnership-level recruitment in law firms or C-suite financial roles can command fees exceeding 30% of first-year compensation. The extensive vetting, cultural fit assessment, and long sales cycles justify these elevated rates.

Optimizing Your Recruitment Budget

Strategic Agency Selection

Matching the right type of agency to each position optimizes costs and outcomes. Generalist firms work well for standard roles with broad candidate availability. Specialized recruiters justify their premium fees for niche positions requiring specific industry expertise.

Quality versus cost considerations require balance. The cheapest agency may deliver poor service quality, unsuitable candidates, or unstructured processes that waste your team's time. Evaluate total cost of ownership, including internal time investment and replacement risk.

Process Efficiency Improvements

Clear, comprehensive job descriptions accelerate searches and improve candidate quality. Ambiguous requirements force recruiters to spend extra time clarifying expectations and often result in misaligned candidate submissions.

Fast decision-making significantly reduces recruitment costs. When companies take weeks to provide feedback or schedule interviews, top candidates accept other offers. This delay forces recruiters to restart searches, effectively doubling the time and cost invested.

Leveraging Multiple Sourcing Channels

Smart organizations combine agency recruitment with internal sourcing strategies. Employee referral programs, social media recruiting, and direct sourcing complement external agency efforts while reducing overall costs.

According to industry research, companies that reinvested 20% of their recruitment savings into upskilling programs saw a 15% improvement in employee retention rates. This creates a virtuous cycle where better retention reduces future recruitment needs.

Performance Tracking and Vendor Management

Establish clear KPIs for agency effectiveness: time-to-hire, quality of hire, retention rates, and hiring manager satisfaction. Regular reviews identify top performers deserving continued partnership and underperformers requiring replacement.

Data-driven vendor management enables objective conversations about fees and performance. When you demonstrate that an agency's quality of hire lags behind competitors, you gain leverage to renegotiate rates or terminate the relationship.

Recruitment Fee Benchmarks by Role Type

| Role Type | Average Fee Range | Typical Timeline | Key Cost Drivers |

|---|---|---|---|

| Entry-Level | 15-18% of salary | 21-30 days | High candidate volume, simple screening |

| Mid-Level Professional | 18-22% of salary | 30-42 days | Skills assessment, cultural fit evaluation |

| Senior Management | 22-28% of salary | 45-60 days | Executive search techniques, extensive vetting |

| C-Suite/Executive | 28-35% of salary | 60-90+ days | Confidential search, passive candidate engagement |

| Highly Specialized Technical | 25-30% of salary | 45-75 days | Rare skills, competitive market, technical assessment |

Questions to Ask Before Signing a Fee Agreement

Fee Structure Clarity

What exactly does the quoted fee include? Request itemized breakdowns distinguishing base placement fees from potential additional charges. Understand how part-time or contract roles are priced differently from permanent positions.

Are there volume discounts available if you anticipate multiple hires? Many agencies offer reduced rates for clients committing to a certain number of placements annually.

Guarantee and Replacement Terms

What constitutes a failed placement requiring replacement? Some agencies only replace candidates who resign or are terminated within the guarantee period. Others exclude terminations for gross misconduct or economic layoffs from guarantee provisions.

Are there limits on replacement searches? Contracts might cap replacements at one or two attempts. Understand what happens if multiple replacements still don't result in a successful long-term hire.

Exclusivity and Competition

Can you engage multiple agencies for the same position? Non-exclusive arrangements allow you to leverage competition between recruiters but may reduce each agency's motivation. Exclusive contracts often secure better service but limit your options.

How does the agency handle candidate conflicts when a candidate applies through multiple channels? Clear off-limits periods and conflict resolution procedures prevent disputes about which agency deserves the fee.

Payment Terms and Timing

When is payment due—upon candidate start date or offer acceptance? This distinction matters if candidates accept offers but never begin employment. Negotiate terms protecting you from paying for candidates who renege on accepted offers.

Are installment payment options available? Some agencies allow splitting fees across the candidate's first few months, improving your cash flow management.

The ROI of Paying Recruitment Fees

Time-to-Hire Reduction

Unfilled roles cost organizations approximately $500 per day in lost productivity. A recruitment agency accelerating your hire by even two weeks delivers substantial value through restored productivity.

The average time to hire stands at 44 days. Effective agencies reduce this timeline significantly, particularly for standard positions. This acceleration directly impacts your bottom line through faster team scaling and reduced vacancy costs.

Quality of Hire Improvements

Superior candidate-role fit drives better performance and higher retention. Agencies bringing specialized expertise often identify candidates who exceed the quality achievable through internal recruiting efforts.

Reduced turnover creates significant savings. Research indicates that replacing an employee costs 40% of their base salary when accounting for recruitment, onboarding, and lost productivity. A successful placement that remains for years delivers exponential ROI compared to the initial agency fee.

Access to Passive Candidates

The best talent isn't actively job searching. Recruitment agencies leverage extensive networks and direct outreach capabilities to engage passive candidates who would never see your job postings.

This access to hidden talent pools represents substantial competitive advantage. When your competitors are fishing from the same active candidate pool, agencies help you access an entirely different market segment.

Employer Brand Protection

Professional recruitment processes reflect positively on your organization. Agencies providing excellent candidate experiences—even for unsuccessful applicants—enhance your employer brand and increase future application rates.

According to Glassdoor research, candidates are 25% more likely to view companies with efficient hiring processes as attractive employers. This improved perception compounds over time, making future recruiting efforts easier and less expensive.